Tax Problems of the Stars

Fox News: “the IRS has filed more than $6.3 million in liens against [Nicolas]Cage for back taxes owed from 2002, 2004, and 2007. . . . But the ‘National Treasure’ star isn’t the first celebrity to owe big money to Uncle Sam. A few have even spent time behind bars for failing to pay taxes. Hopefully, Nic will avoid that fate and start building up his nest egg with the earnings from the four films he’ll be starring in next year. In the meantime, maybe he can get a few tips from these celebrity tax evaders.”

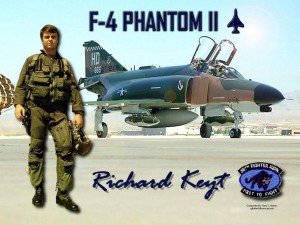

For five years in the USAF I flew the multi-million dollar supersonic (mach 2+)

For five years in the USAF I flew the multi-million dollar supersonic (mach 2+)