Recovery Threatened by Runaway Student Loan Debt

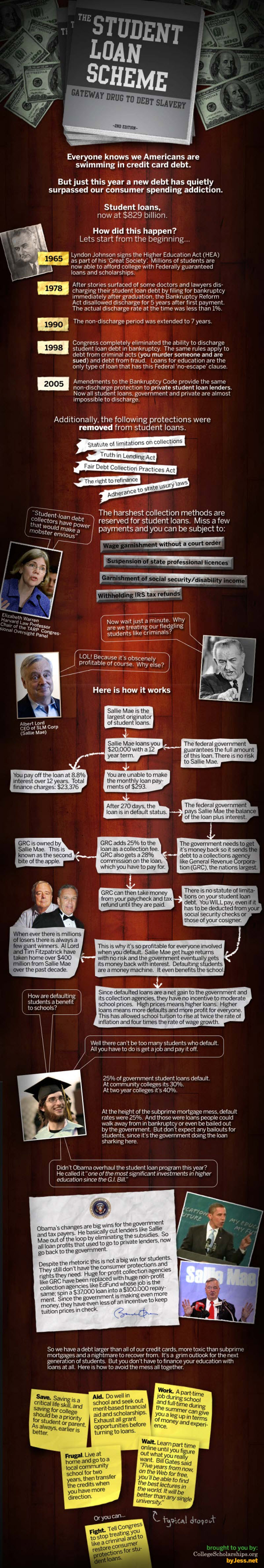

Today’s Middle Class is feeling squeezed from multiple directions: underwater with their homes and mortgage loans, feeling the impact of a faltering economy, and overwhelmed by debt. Student loan debt is a non-yielding threat to the majority of struggling middle-class professionals and, surging above $1 trillion, U.S. student loan debt has surpassed credit card and auto-loan debt in the U.S. The National Association of Consumer Bankruptcy Attorneys warns that escalating student loan debt and delinquencies could be the next debt bomb for the U.S. economy.