The Treasury Inspector General for Tax Administration today released its annual review of the IRS’s Volunteer Income Tax Assistance and Tax Counseling for the Elderly programs entitled “Ensuring the Quality Assurance Processes Are Consistently Followed Remains a Significant Challenge for the Volunteer Program.” Forty-one percent of the test tax returns prepared by volunteers were incorrect.

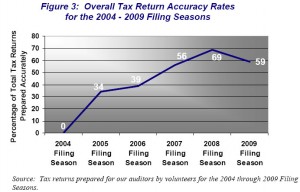

The accuracy rates for tax returns prepared at Volunteer Program sites decreased for the first time in five filing seasons. Of the 49 tax returns prepared for our auditors by Volunteer Income Tax Assistance and Tax Counseling for the Elderly sites in the 2009 Filing Season, 29 (59 percent) were prepared correctly and 20 (41 percent) were prepared incorrectly. If 17 of the incorrectly prepared tax returns had been filed, taxpayers would not have received $4,138 in tax refunds to which they were entitled. Alternatively, if the remaining 3 incorrectly prepared tax returns had been filed, the IRS would have incorrectly refunded $4,575.

Leave A Comment

You must be logged in to post a comment.