Tax Girl: “tucked in the middle

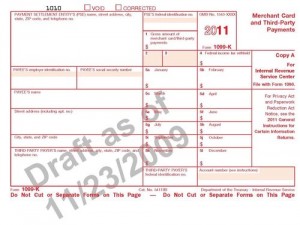

[of the Housing Assistance Tax Act of 2008] is a new requirement that banks and credit card merchants to report payments to the IRS. . . . . What this means is that taxpayers who have a credit card merchant account, Paypal account or similar account and otherwise meet the criteria will receive form 1099-K from their service provider at the end of the year. The form 1099-K will report the gross amount paid out to the taxpayer with no adjustments for fees or chargebacks (an issue that is, admittedly problematic).” Here’s the 1099-K form:

Leave A Comment

You must be logged in to post a comment.