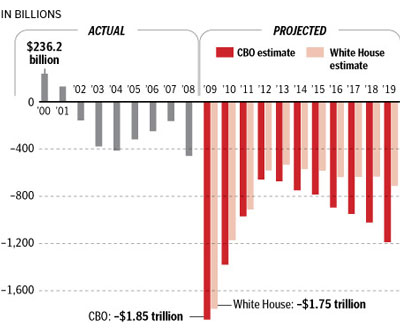

A lot of politicians and pundits are grossly misinformed about the deficits during the Bush era, the actual deficits in 2009 and estimated deficits through 2019. The following chart prepared by the nonpartisan Congressional Budget Office shows the night and day budget deficit difference between the two administrations. When you look at the chart, remember three key facts:

- Congress determines the spending of the federal government, not the President. Yes, the President gives his input to Congress, but ultimately it is Congress that writes and passes the laws that set government spending.

- The Democrats have had control of the House and the Senate since 2007 and are responsible for passing all federal spending bills during 2007, 2008 and 2009, which includes the last two years of Bush’s administration. Therefore, when you ask how much did Bush spend while in office, do not include his last two years because it was the Democrats who set spending in those years.

- The 2009 expenditures were greatly increased because of the emergency TARP money spent to bail out the banks.

Wall St. Journal: “Deficit to Hit All-Time High. Obama’s $3.8 Trillion Budget Forecasts a $1.6 Trillion Shortfall for 2010 Before It Drops. President Barack Obama will propose on Monday a $3.8 trillion budget for fiscal 2011 that projects the deficit will shoot up to a record $1.6 trillion this year, but would push the red ink down to about $700 billion, or 4% of the gross domestic product, by 2013, according to congressional aides. The deficit for the current fiscal year, which ends on Sept. 30, would eclipse last year’s $1.4 trillion deficit, in part due to new spending on a proposed jobs package.”

A story in Reuters today states, “he White House will predict a record budget deficit in the current fiscal year and more big shortfalls for the next decade in its upcoming budget proposal . . . . In its budget proposal to be released on Monday, the White House predicts a record $1.6 trillion budget deficit for the fiscal year that ends September 30 . . . . ”

Obama vs. Bush Deficits

Leave A Comment

You must be logged in to post a comment.